In 1970, the UK and Norway both discovered oil in the North Sea.

The UK sold their reserves to private markets while Norway kept state ownership.

This ONE decision created the biggest wealth gap in European history.

Here's the full story: 🧵 https://t.co/1X5q2vNXRA

The discovery was monumental.

In the UK, BP found the massive Forties Field.

In Norway, Phillips discovered the enormous Ekofisk reserve.

Both nations didn't know how they would manage this newfound wealth.

But here's where everything changed: https://t.co/BSjTkzgbOk

The UK, under Margaret Thatcher, chose privatization.

BP, British Oil, and other state assets were sold to private companies.

The thinking was simple: Let the free market handle it. Government shouldn't interfere.

But Norway saw things differently... https://t.co/3rFIUo0OeE

Norway created Statoil - a state-owned oil company.

They maintained 50% ownership in every oil field.

But the real game-changer was when they created a sovereign wealth fund in 1990.

And that meant that: https://t.co/tMIGjksxJJ

Every dollar of oil profit went into a national savings account.

The fund could only spend 3% per year.

The rest? Invested for future generations.

And to this day, no one could have predicted the results... https://t.co/R1UxGy3pbY

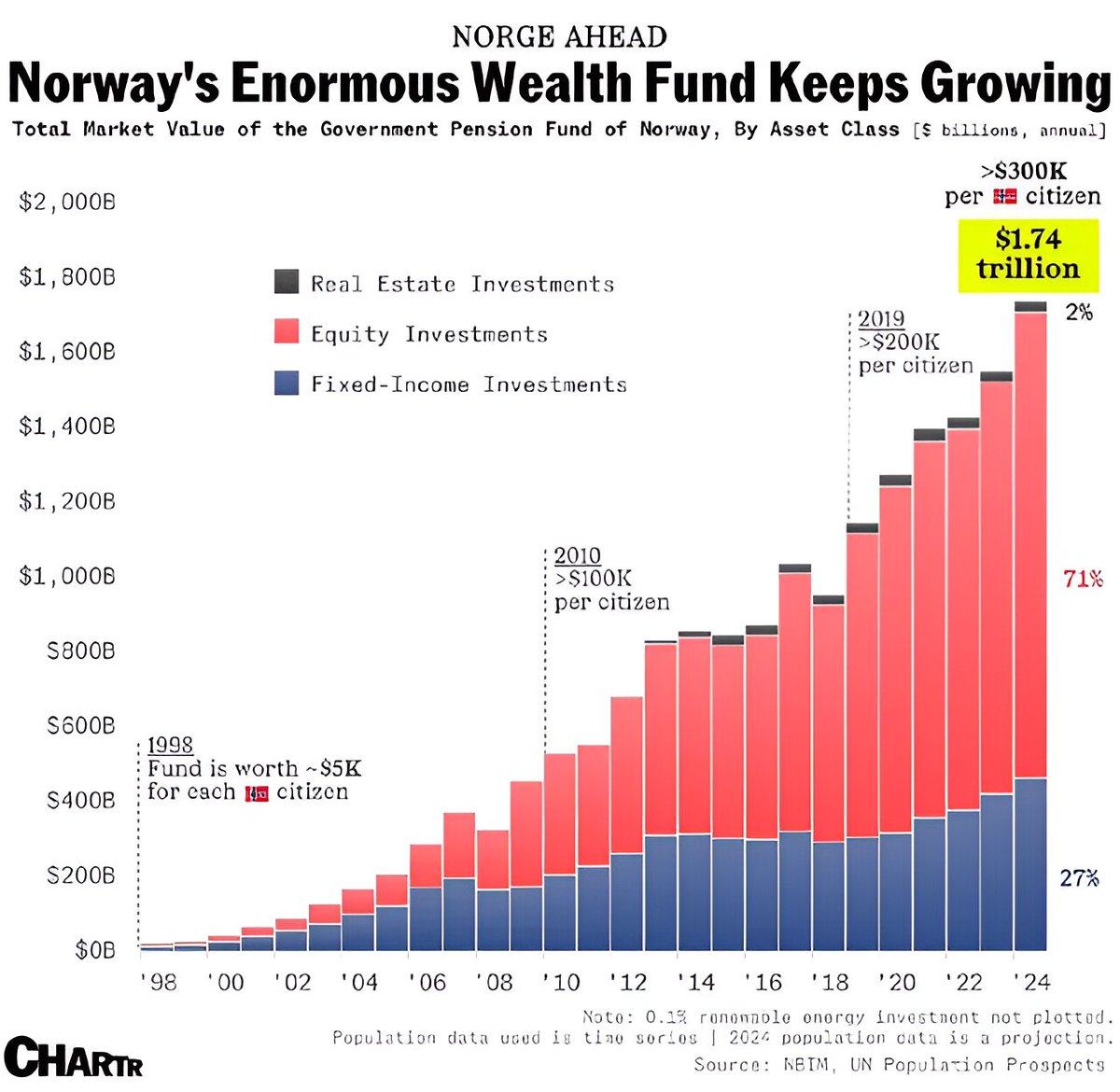

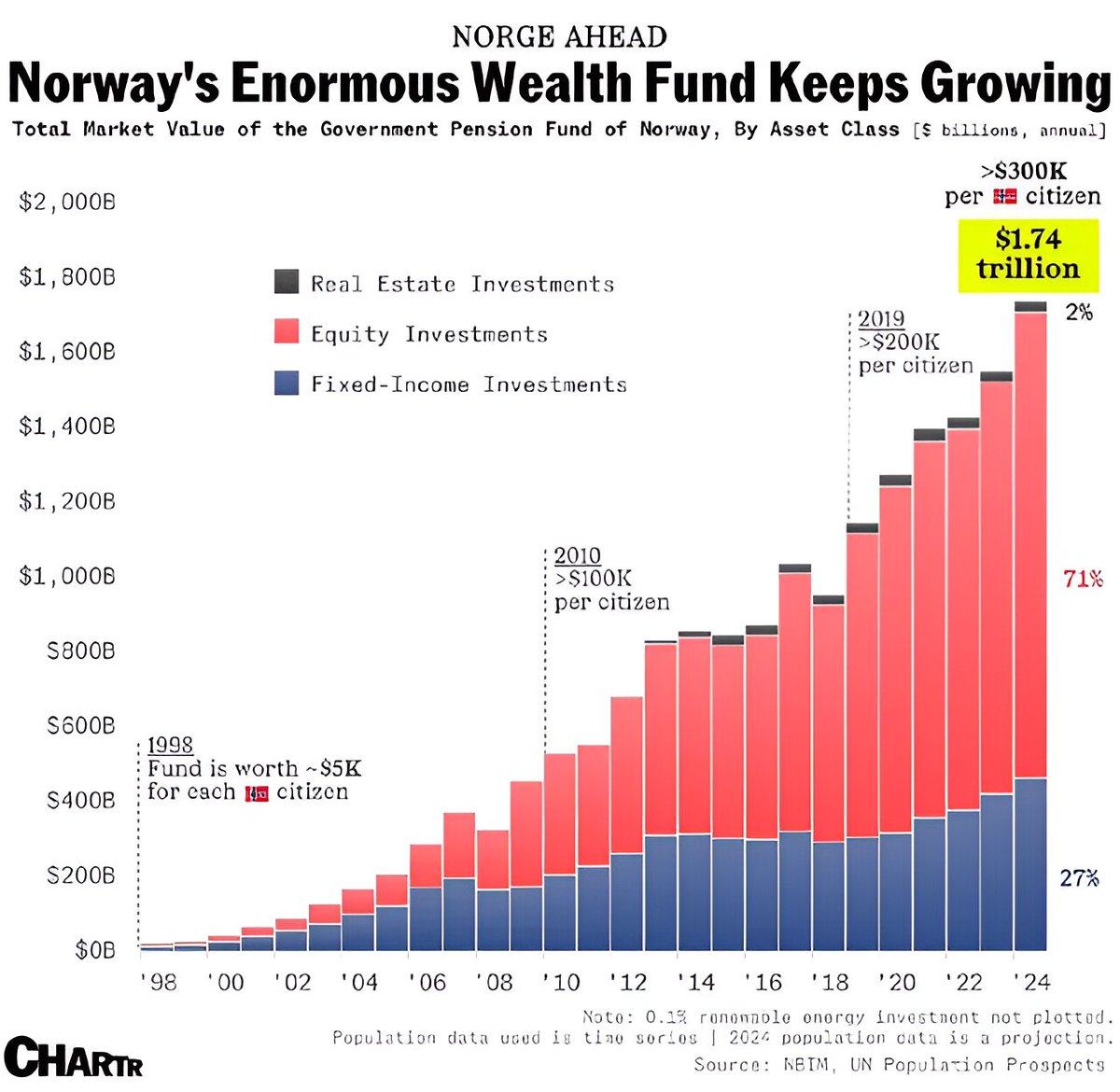

That fund is now worth $1.3 trillion.

It owns about 1% of ALL stocks in the world.

That's $150,000 for every Norwegian citizen.

Meanwhile in the UK? https://t.co/CPJpbDcv5w

In 2020, the UK received just £0.2 billion from North Sea oil.

Norway? £9 billion.

That's 45 times more revenue.

But here's what most people miss:

In both scenarios, regular citizens lost out.

• UK: Big corporations took the wealth

• Norway: Big government took the wealth

The average citizen? Just a spectator watching others profit from their natural resources.

But here in the US, we do things differently: https://t.co/TNT8C9ynov

We're the only major nation where private citizens can own mineral rights.

This means everyday Americans––not just governments or corporations––can benefit directly from natural resources.

Because we have something better:

Direct ownership of our resources.

In America, we don't need government funds or corporate handouts.

Private citizens can build their own wealth through energy investments.

Here's how: https://t.co/G4Ps0nlNUr

We focus exclusively on fixed-rate energy investments with established production.

Investments in stable, income-producing assets that pay you month after month, year after year.

While banks offer 2-3% interest and the stock market swings wildly, our energy investments offer:

Fixed 10% yearly returns, paid monthly.

It's "mailbox money" that beats inflation and provides the steady income that savvy investors need for retirement.